The Budget Busting Bill that hurts the poorest of us

Restricting our social safety net while increasing our debt

First up: See my previous post on debt and deficits, and Medicaid and CHIP, from the first time the House Republicans tried to pass this bill. There’s a bunch of stuff in there about the size of the U.S. debt, the recent history of the debt, and deficits vs. debt, as well as info on who benefits from Medicaid and the Children’s Health Insurance Program.

The Big Beautiful Bill (H.R. 1) is, indeed, big. The most notable aspect of its bigness is not, however, its length, but its cost. And what will the American people get for that high cost? Less.

That’s right. House Republicans must have gotten the basics of budgeting mixed up, because they have crafted a bill that maximizes expense while minimizing services, rather than the reverse.

You might be thinking, “Now just hang on a second there. It’s mighty unfair of you to classify a tax cut as an expense! I’d say that’s a savings for me!” And under different circumstances, that would be a valid counter-argument.

But under the current circumstances, the tax cuts in this bill will add significantly to the national debt. This is because the tax cuts (1) are not offset by spending cuts and (2) the borrowing costs of the U.S. have increased. Right now, the U.S. pays more in interest than it does on any program other than Social Security.

While it’s true that U.S. federal debt is not the same as household debt (because the U.S. has control of the currency in which the national debt is issued), an unreasonable amount of debt can still be harmful, because it can affect our future ability to fund our needs. Unreasonable means debt that is so high that lenders (i.e., bond purchasers) become concerned that we won’t make timely payments on our loans. One indicator of worryingly high national debt is when it outpaces national income, or GDP (gross domestic product). Right now, U.S. debt is more than 120% of GDP.

This can cause a dangerous spiral: lenders require higher interest rates to cover the perceived risk of investing in the U.S., so the total debt increases because we owe even more money than we borrow, so we need to borrow more, etc. etc. The interest rates at which the U.S. needs to sell bonds are relatively high right now—lenders are getting “jittery”—which means that the cost of new debt (and the cost of refinancing our old debt), is, well, costly.

The national debt is held by all of us, while the tax cuts will only disproportionately benefit the wealthiest of us (see below). We will all feel pain should the growing national debt force the U.S. into making tough decisions in the future, when the cost of borrowing becomes untenable.

Maya MacGuineas, from the bipartisan Committee for a Responsible Federal Budget said:

This plan is nothing short of a fiscal failure. It adds massively to the national debt, it relies on timing gimmicks and false claims about growth, it fails to make the structural spending reforms we desperately need, and it uses the important savings it does find to partially offset tax cuts rather than reduce the debt.

The fact that lawmakers passed this bill less than a week after America’s latest credit downgrade and yet another worrying Treasury auction is especially maddening. Will nothing wake our leaders up to the need to take our debt challenges seriously?

[…]

And at a time when we need serious plans to reduce deficits and address rising government spending, this bill lowers projected spending by around 1 percent while increasing deficits by closer to 15 percent or more. While some are heralding this as a major success in controlling spending, spending would continue to grow rapidly after this bill – totaling about $85 trillion through 2034, compared to nearly $86 trillion under the current baseline.

With debt approaching record levels and interest costs surging, approving another $3 trillion of borrowing right now is nothing short of negligence.

Jessica Reidl of the relatively conservative Manhattan Institute is a renowned expert on the federal debt. Here are a couple of her responses to the bill:

This tax bill will cost more than the 2017 tax cuts, the CARES Act, Biden’s stimulus, and the Inflation Reduction Act combined. It would add $6 trillion over 10 years to the deficit.

and

The biggest story few are talking about: CBO projects that the government's interest rate never exceeds 3.6% over 30 years. If rates remain at 4.5%, that adds $40 trillion more to interest costs over 30 years - as much as adding a second Defense Department.

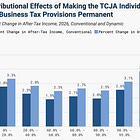

Riedl and MacGuineas are not the only ones who noticed the particular problem with increasing the debt now, right when interest rates are ballooning. In March, the Congressional Budget Office (CBO) issued a report entitled “Projections of Deficits and Debt Under Alternative Scenarios for the Budget and Interest Rates” that projected how much the debt will increase if the Trump tax cuts are extended and if interest rates are high—which is exactly the situation this bill would put us in:

None of those scenarios are good, and we are staring down the barrel of the pink one.

Remember—one reason interest rates are rising is concern over the increasing debt itself, including this bill’s effect on the debt specifically. Can increased interest rates on U.S. debt impact us as individuals? Yes. If U.S. debt interest rates increase, all U.S. lending interest rates could increase, as they are generally benchmarked to U.S. debt rates. For instance, if the Treasury rates increase, mortgage rates increase. This means that this bill could directly lead to higher mortgage and other loan rates.

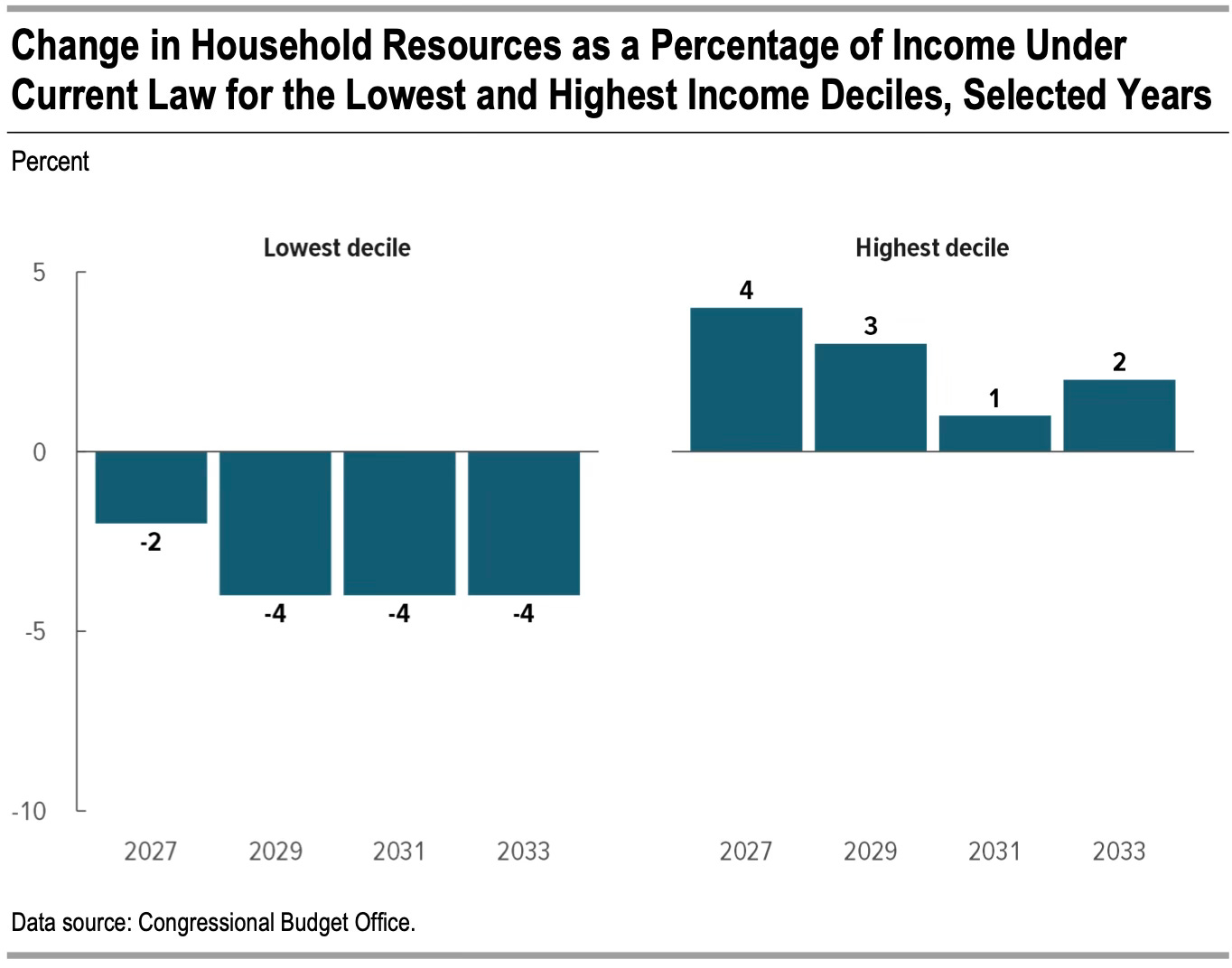

Because the Big Beautiful Bill changed so much right before the vote, the Congressional Budget Office (CBO) didn’t get a chance to review the version that was actually voted on. But the version they did review on May 20, was pretty similar. Notably, they released a preliminary analysis of the distributional effects of the bill; that is, how the bill will impact people of different income levels. They reported:

The agency estimates that in general, resources would decrease for households in the lowest decile (tenth) of the income distribution, whereas resources would increase for households in the highest decile.

So, the richest people will benefit while the poorest lose. And we all lose if the debt situation implodes.

What’s in the Bill? How will it hurt the lowest income earners?

Despite the enormous debt it will add, the bill does contain a lot of spending cuts, and many of those cuts will be extremely painful for the most vulnerable Americans. It is true that the major benefit programs—Social Security, Medicare, and Medicaid—are major sources of U.S. debt, and there are good arguments to be made that programmatic reform much be part of reducing the debt (of course, increasing our income *cough cough* taxes is needed, too). One of the most salient takeaways from this bill is that it cuts benefits—and will cause suffering—for no good reason; this bill won’t reduce our debt, it will increase it!

Here are some of the most critical changes that the bill would make to the Supplemental Nutritional Assistance Program (SNAP, aka “food stamps”), Medicaid and the Children’s Health Insurance Program (CHIP), and the Affordable Care Act, all critical components of our social safety net:

Sets more stringent limits on exceptions to SNAP work requirements, including a sunset provision that would make veterans and those who are homeless subject to work requirements.

States will have to pay 5% of SNAP benefits instead of 0%, with higher penalties if states have payment error rates greater than 6%. Here are the SNAP payment error rates by state for 2023. Only seven states were below 6%.

States will have to pay 75% of SNAP administrative costs instead of 50%, even while the other SNAP provisions in the bill will require more administrative labor.

States must regularly verify address and SSN of Medicaid and CHIP recipients and implement a system to prevent multiple enrollment.

States must automatically unenroll individuals thought to be deceased from Medicaid. Disenrollment will occur quarterly.

States must screen Medicaid provider participation monthly and do a quarterly screening to see if a provider is deceased.

States must redetermine eligibility of Medicaid expansion recipients every 6 months instead of every 12 months.

States no longer have to provide Medicaid or CHIP benefits within the “Reasonable Opportunity Period” that applicants have to verify their immigration status. (Yes, that includes CHIP, so that includes children.)

The federal share of Medicaid expenditures will be 80% (instead of 90%) for any state that “provides any form of financial assistance […] regardless of the source of funding for such assistance” to immigrants not eligible to purchase health insurance. Note that this is regardless of the source of funding. Even if a state uses its own funds to cover the cost, they will receive only the penalty rate of 80%. In a statement, the American Hospital Association noted that “hospitals are required to treat patients regardless of immigration status”.

There will be a moratorium on requirements to improve staffing standards for long-term care facilities paid by Medicaid and Medicare.

Medicaid and CHIP retroactive care will be reduced to one month before the application for assistance instead of three months before.

No federal funding for “gender transition procedures”. The bill lists a bunch of exceptions, which somewhat prove how problematic the provision is: can the law ever be expected to cover every medically necessary exception? Of course not; medicine is more complex than written law. That is why we leave medical decisions to doctors.

Limits how much states can tax provider revenues, which is one way many states fund their Medicaid programs. Also limits state directed payments to providers, which states can use to incentivize providers in areas where care is expensive (e.g., rural areas).

Sets a work requirement for Medicaid. Technically, it’s a “community engagement requirement.” Although there are some limited exceptions, generally able-bodied, non-pregnant adults will be required to demonstrate 80 hours/month of work or community service, or be enrolled half-time in an educational program.

Requires cost-sharing for Medicaid expansion enrollees who earn above 100% of the federal poverty level (maxed at $35/service and 5% of annual income total).

Stricter limitations on ACA Marketplace enrollment periods; stricter income verification; no extensions allowed beyond the current 90-day allowable period to resolve data inconsistencies with enrollment; DACA recipients no longer able to purchase Marketplace Coverage.

And a last-minute doozy of an addition: ACA Marketplace plans cannot be reimbursed for the lower cost-sharing of low-income enrollees if the plan offers abortion coverage. Since some states require that Marketplace plans offer abortion coverage, this sets up an immediate conflict between the federal government and several states, and could severely limit the plan offerings in the Marketplace for low-income Americans.

There is at least one provision that is likely to have bipartisan support: the bill limits profits to Pharmacy Benefit Managers. That is, the pharmacy benefit insurance plan cannot charge exorbitantly more than the cost of the drug + the cost of dispensing the drug. Only a limited administrative fee is allowed.

(Here’s the bill itself. Here’s a summary of the health provisions by the Kaiser Family Foundation. Here are statements of concern from the American Hospital Association.)

As you can see, the bill largely relies on increasing administrative burdens that will have the effect of limiting eligibility, thus ultimately saving money by denying assistance. It’s like Congress is getting its health insurance ideas from UnitedHealth. Perhaps the most brutal part of the cuts are the timing: this bill threatens to kick a lot of people out of our social safety net just when the international trade turmoil is risking recession or a period of slowed growth (think higher unemployment and lower wage increases).

This bill would also transfer costs of assistance from the federal government to the states, which could seriously impact state budgets. This is likely to be a major concern for the Senate.

Will the Senate pass the bill?

Several Republican senators are speaking out against many of the provisions in the bill. Sen. Josh Hawley (R-MO) even went to the New York Times to defend Medicaid.

Even if Senate Majority Leader John Thune (R-SD) could wrangle more than 50 senators to vote for this bill, it’s unclear that the bill, as is, would get the Senate parliamentarian’s approval for passage under the reconciliation process, which would only require a simple majority of senators in favor of passage rather than 60. Disregarding the parliamentarian’s ruling would be “the nuclear option”—doing away with the legislative filibuster.

In his first remarks as Senate Leader, Thune said:

And one of my priorities as leader will be to ensure that the Senate stays the Senate. That means preserving the legislative filibuster – the Senate rule that today has perhaps the greatest impact in preserving the Founders’ vision of the Senate.

Did he mean it? Maybe not. Just last week, Senate Republicans voted to repeal California’s waiver to set its own vehicle emissions standards, despite the ruling of the Senate parliamentarian that, under Senate rules, the vote should be subject to the filibuster. Thune claimed this was OK because the parliamentarian was wrong—that the CA waivers were rules subject to congressional review, which does not require a supermajority. But it certainly set a precedent for ignoring the parliamentarian.

Whether or not the Republicans ignore the parliamentarian again might depend on how rancorous the wrangling over the bill becomes, and whether or not a bill that can qualify for reconciliation could actually withstand another close vote in the House.

Yes the poorest will suffer.Commenting from here in Donnie T country. Medicaid pays the bills for many people here and keeps the hospitals open. Brings doctors to the hills. Work requirements will cut people off. Our rep Andy Barr calls not extending the tax cuts a tax increase. The poorest already do not have enough income to be liable to pay income tax. They will only lose benefits like SNAP and health care. I am afraid senators like Rand Paul will call for even more cuts.